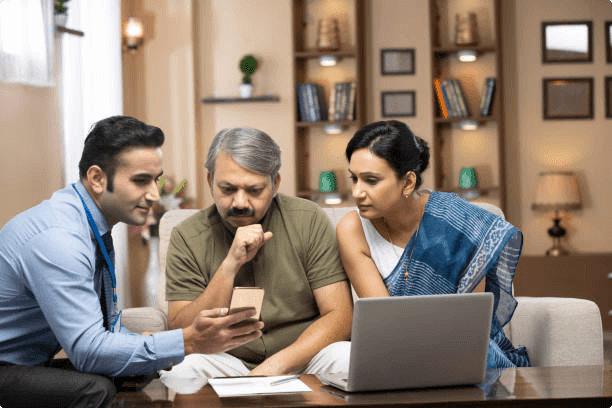

The Finance Maestro offers Top Loan Against Property in Noida to help you unlock funds quickly and efficiently. Whether you need money for business expansion, home renovation, or personal needs, our loan against property provides high loan amounts at lower interest rates compared to personal loans. The Finance Maestro can provide you with access to capital easily due to its flexible repayment plans, minimal documentation, and quick approval process. You will find clear terms, professional support, and a reputable partner to help you secure a loan for your property located in Noida when you apply today.

apply right now!Property home Loans in Noida with The Finance Maestro are beneficial for both personal and commercial use as they allow for quick access to large amounts of money that are less expensive than personal loans. With Property Home Loan from The Finance Maestro, you can use the equity of your property (either residential or commercial) as collateral. This allows for lower rates and higher amounts due to the use of property as collateral With flexible repayment plans based on your ability, as well as extended loan terms that lessen your monthly expenses, it is easy to choose an EMI that fits within your budget. The process is easy to use, with minimal paperwork required and fast approach. By utilising a property as security for your property loan, you will qualify for a larger amount at a lower rate of interest. The Finance Maestro offers clear and straightforward fees, professional guidance, professional and dependable services. You can trust The Finance Maestro as being the best partner for your investment needs in Noida.

A loan against property meaning will be incomplete without knowing about its eligibility. Different banks and NBFCs have their own criteria to evaluate and approve a LAP scheme, but you can get an idea by understanding the common loan against property eligibility criteria they usually follow that are listed below:

| Age | Nationality | CIBIL Score | Employment Status | Work Experience | Income | Property Type |

|---|---|---|---|---|---|---|

| 18 to 70 years | An Indian citizen with collateral property in India | 750 or more | Salaried, self-employed professional, or self-employed non-professional | Minimum 1 year in the current organization (If salaried) | Must have a stable income | Residential, commercial, or industrial property that can be pledged as collateral |

Compare interest rates, processing fees, and features from India's leading banks offering home loans.

Ensure a hassle-free loan against property approval by keeping these documents ready before applying.